Why a Company You’ve Never Heard of Is One of the Best Nasdaq-100 Stocks of the Year

Occupying the runner-up spot behind retail darling Palantir (PLTR) in the race for the best-performing stocks in the Nasdaq-100 ($IUXX) is no easy feat. This means one has to outperform giants such as Nvidia (NVDA), Microsoft (MSFT), and Meta (META). With a YTD rally of 59.4%, shares of IDEXX Laboratories (IDXX) have done this quite comfortably.

About IDEXX Laboratories

Founded in 1983, IDEXX Laboratories is a vet tech company that develops, manufactures, and distributes diagnostic and software solutions for companion animals, livestock, and water testing markets. With constant innovation, led by its SNAP tests and cellular analyzers, the company has become the global leader in veterinary diagnostics, software, and water testing.

The company’s market cap currently stands at $54.9 billion. At the start of the year, it was around $34 billion. So why are investors so hot on IDEXX right now? Let’s find out!

Blockbuster Q2 Results

One of the primary reasons for the outperformance in IDEXX’s share price has been its recent solid quarterly results. The company has reported an earnings beat in each of the past four quarters.

In Q2 2025, IDEXX reported revenues of $1.1 billion, which marked yearly growth of 11%. The Companion Animal Group or CAG, the largest business segment of the company, generated 10% organic revenue growth. Within that, the IDEXX VetLab consumables segment reported 14% organic revenue growth. Overall, product and service revenues came in at $657.6 million and $451.9 million, up from $577.3 million and $426.3 million in the prior year, respectively.

Meanwhile, earnings surged by 49% in the same period to $3.63 per share, coming in ahead of the consensus estimate of $3.30 per share. Notably, gross and operating margins improved as well to 62.6% and 33.6% compared to 61.7% and 26.3%, respectively.

However, for the six months ended June 30, 2025, net cash from operating activities came down to $423.7 million from $446.9 million in the year-ago period. Overall, the company closed the quarter with a cash balance of $164.6 million, higher than its short-term debt levels of $75 million.

Encouragingly, IDEXX raised its revenue guidance for the year to between $4.21 billion and $4.28 billion from between $4.09 billion and $4.21 billion earlier, coupled with a rise in the EPS range to $12.40-$12.76, up from $11.93-$12.43 previously.

IDEXX Has a Competitive Edge But Creates Valuation Concerns

IDEXX Laboratories stands out for its consistently strong financial footing, largely driven by the dependable nature of its recurring revenues and long-term client relationships. Its strategy of focusing on consumable products with high margins has not only bolstered earnings, but also ensured stability across economic cycles.

Over the years, IDEXX has developed a comprehensive diagnostic infrastructure for veterinary use, giving it a clear strategic lead. A critical element within this ecosystem is the CLIP cartridge or Chemistry Liquid In-Pack. These are preassembled panels of dry chemistry slides, tailored to conduct specific blood tests such as those related to liver health, kidney function, or broader wellness metrics. These CLIPs are loaded into the Catalyst One device, an analyzer widely used in veterinary practices for in-house blood testing. Catalyst One enables clinics to run tests on-site and receive results within 10-15 minutes, streamlining the diagnostic process. Once the analysis is complete, data is both displayed on-screen and automatically transferred to the IDEXX VetLab Station. This central interface coordinates information from all connected instruments in the clinic. Its touchscreen display and software integration reduce manual steps and help prevent data handling errors. Monthly calibration using the SmartQC solution, developed by IDEXX, is required to maintain precise results.

Meanwhile, IDEXX has introduced two notable offerings that can be significant future growth drivers. One is the inVue Dx cellular analyzer, which uses AI-driven tools to automate several routine lab tasks. This system has seen strong initial adoption with 2,400 units being placed in the second quarter of 2025. The other is the Cancer Dx panel, a diagnostic test capable of detecting canine lymphoma from a blood sample. Within a month of launch, over a thousand clinics had already placed orders, reflecting high demand.

Future plans include a steady expansion of IDEXX’s diagnostic toolkit. The company intends to roll out additional cancer-related tests and extend the functionality of inVue Dx to support fine needle aspirate procedures. These steps are expected to enhance the depth and frequency of diagnostics conducted during pet visits, contributing to higher adoption of IDEXX solutions across veterinary practices.

However, amid all this optimism, the stock is trading at punchy valuations and a significant premium to the industry average. Its forward price-earnings, price-sales, and price-cash flow at 43.86x, 10.38x, and 37.07x are all considerably higher than the sector medians of 16.87x, 3.45x, and 13.76x, respectively.

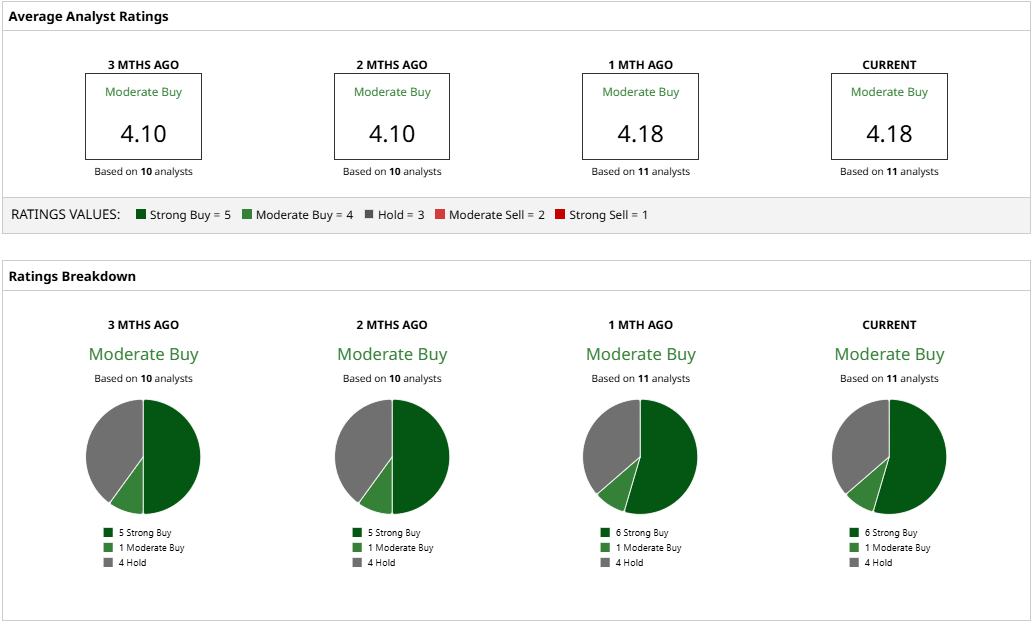

Analyst Opinions on IDXX Stock

Taking all of this into account, analysts have rated IDEXX stock a “Moderate Buy” with a mean target price and high target price of $558.30 and $626, respectively. Both has been surpassed in another nod to the significant share price rally. Out of 11 analysts covering the stock, six have a “Strong Buy” rating, one has a “Moderate Buy” rating, and four have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.