Trading futures intraday the "grown ups" way

Trading the intraday timeframe especially with futures instruments that make big moves covering wider indices like the Nasdaq, can never be easy. I've heard from several who have been in this business and have given up having wiped out their own accounts then spent a ton of money trying “Prop” firms and blowing up account after account and still not learning. The extremes have had traits that align with methods such as chasing trades instead of letting them come to you, erasing hard-fought gains with merely over-trading , rationalizing terrible trades with worthless mental what-if scenarios , and going to extremes of crying yourself to sleep at night. Success comes in not just setting goals and sticking to them, including walking away when daily goals are met/unmet, but using a tested repeatable methodology which can be repurposed and executed regardless of the trading environment or for that matter, whatever instrument one is trading.

We present an example of our trading from Friday where environment variables aligned well with “long biased” trade entries and not chasing the smaller reversals with shorts. The markets this past Friday, were up handsomely in the post session from Thursday following upbeat results from Microsoft and Alphabet and futures in the Nasdaq especially, rose significantly after the close after participants digested the results and the earnings conference calls that followed. It was heartening for a market that had been buoyed in recent session with lukewarm results from the like of Netflix and Meta where the sell-offs were deep following earnings results.

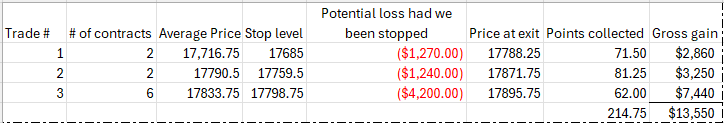

We isolated the Nasdaq futures in our trades on Friday and elected to allow the market to unravel past the economic calendar announcements and the day came with the all-important Fed watched report of Personal Consumption and Expenditure which showed a flat m/m reading but ballooning consumer spending and signs of wage inflation. I am sure the BEA will deliver revisions in the upcoming month to this reading that read like this: Personal income increased $122.0 billion (0.5 percent at a monthly rate) in March. Disposable personal income (DPI)—personal income less personal current taxes—increased $104.0 billion (0.5 percent). Personal outlays—the sum of personal consumption expenditures (PCE), personal interest payments, and personal current transfer payments—increased $172.1 billion (0.9 percent) and consumer spending increased $160.9 billion (0.8 percent). Personal saving was $671.0 billion and the personal saving rate—personal saving as a percentage of disposable personal income—was 3.2 percent in March. Of course the futures markets initial reaction got tamed into the open and the markets futures had the opportunity to pull back sufficiently into the open and minimally offer a gap filled environment from prior settlements. Below we present 3 images of trades taken using simple Fibonacci measurements and allowing for the momentum trade off the open to deliver measurable retracements into the initial 10 minutes past the open. While the narrative on the charts are self explanatory, we detail the actual entry and exit levels in this simple table which resulted in making directionally long biased trades on a trending day that delivered an average of +210 points on the Nasdaq:

Trade recap

Charts with entry criteria

Chart supporting trade # 1

Chart supporting trade # 2

Chart supporting trade # 3

On the date of publication, Murali Sarma did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.